18 November 2009

Tailings dam failures and the price of commodities

Posted by Dave Petley

A couple of weeks ago the University of Alberta hosted a conference entitled “Tailings and Mine Waste 2009“. Impressively, all of the presentations from the meeting have been posted online on an FTP site here. Most of the presentations focus upon technical aspects of tailings facility design, but there is a very interesting talk from Michael Davis and Todd Martin from AMEC online as a pdf here. This presentation examines the relationship between the occurrence of tailings dam failures and the economic cycle of commodities. I should say upfront that I find parts of the presentation rather uncomfortable (especially the back-slapping aspects of the last slide regarding the oil sands industry), but the core point of the presentation is certainly thought provoking.

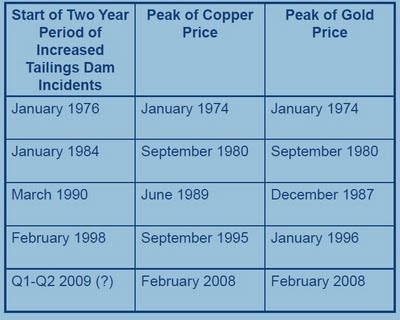

In the presentation they note that between 1968 and August 2009 there were 143 documented tailings dam failures worldwide. However, the occurrence of these failures appears to be cyclic with time, with peaks in the periods 1976-8, 1984-6, 1990-2, 1998-2000 and 2008-now. They compared these peaks with the cyclicity of the global copper and gold prices. The key part of the presentation is a table that compared the timing of the peaks:

The authors’ conclusion is that there is a relationship between the peak in commodities prices and the occurrence of tailings dam failures, with a lag between the two of about two years. I must admit that I am a little unconvinced by the statistics of this analysis (I would like to see a proper regression analysis to see whether this link is statistically valid – and to be fair the authors recognise that this is not a scientifically-rigorous analysis), but the central point is one that is certainly very thought provoking. Increased commodity prices drive increased exploitation. The relationship between the peak in prices an the peak in accidents is ascribed by the authors to:

The authors’ conclusion is that there is a relationship between the peak in commodities prices and the occurrence of tailings dam failures, with a lag between the two of about two years. I must admit that I am a little unconvinced by the statistics of this analysis (I would like to see a proper regression analysis to see whether this link is statistically valid – and to be fair the authors recognise that this is not a scientifically-rigorous analysis), but the central point is one that is certainly very thought provoking. Increased commodity prices drive increased exploitation. The relationship between the peak in prices an the peak in accidents is ascribed by the authors to:

- The rush to mine quickly means that design and construction standards may be low;

- Rapid turn-over of key staff as new (presumably lucrative) opportunities arise during the boom;

- The boom drives the development of resources in areas that are known to be difficult;

- after the boom there are pressures to cut costs as commodity prices decline;

- The boom drives the use of inappropriate designs imported from other locations;

- There may be a lack of independent review, presumably to avoid the time delays and costs associated with this.

The implications of all this are sobering. The most recent boom ended in 2008, and the average lag is 25 months for copper and 29 months for gold. This should mean that the peak in tailings dam failures should be expected 12 to 30 months from now.

Hat-tip to Jack Caldwell’s excellent I think Mining blog for highlighting this paper.

Dave Petley is the Vice-Chancellor of the University of Hull in the United Kingdom. His blog provides commentary and analysis of landslide events occurring worldwide, including the landslides themselves, latest research, and conferences and meetings.

Dave Petley is the Vice-Chancellor of the University of Hull in the United Kingdom. His blog provides commentary and analysis of landslide events occurring worldwide, including the landslides themselves, latest research, and conferences and meetings.

There might be other kinematic issues here as well – a more rapid filling of tailings ponds in boom times

The paper by Davies and Martin seems both very well conceived and somewhat tongue in cheek. However, the main conclusions are indeed sobering and likely very astute and accurate. What they are saying is that there are only enough good designers and operators to go around for average conditions and boom conditions stretch those resources to the point where other resources are used and the results can be (and have been) catastrophic. Added the kinematic issues that hypocentre notes above (good point!), and you have all the ingredients you need for a failure.Seems a lot of effort by mining companies, consultants, regulators and educators over past years to look at technical side of mine tailings failures but little attention to the human equation root cause. Kudos to Davies and Martin for bringing what is likely the key driver to the issues to light and having an ability to back it up with interesting data.

[…] A paper published in 2009 at a conference in Canada indicated that tailings failures typical increase during periods of lower metals prices on the world market. That is exactly the situation being experience currently. […]

[…] Latest reports from Minais Gerais state is Brazil suggest that there are now two known fatalities from the Samarco tailings dam disaster that devastated Bento Rodriguez, but that a further 28 people remain missing. News reports suggest that about 60 million cubic metres of sludge were released when two tailings dams collapsed. Samarco is now coming in for some criticism for their response to the disaster, and it will be very interesting to see how they handle the inevitable investigation into the dam itself. The fact is that tailings dams should not fail like this – although they do so alarmingly often. […]

[…] is time that the industry learnt from this important conclusion. Tailings dam failures increase when commodity prices decline. This does not bode well for the next couple of […]